How many years do you have to be separated to be legally divorced in Texas?

Table of Contents

How many years do you have to be separated to be legally divorced in Texas?

three years

Can I put single If I am divorced?

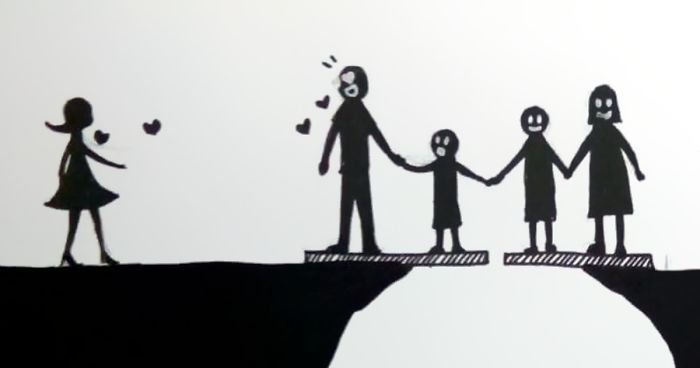

As a single person, you are not legally bound to anyone—unless you have a dependent. You can be considered as single if you have never been married, were married but then divorced, or have lost your spouse. It is possible to be single at multiple times in your life.

Can both divorced parents file as head of household?

If the divorce agreement specifies that one child lives the majority of the time with one parent and another child lives most of the time with the other parent, both may be able to file as a head of household.

Can you file married filing separately if you live together?

You can file your federal return as Married Filing Separately even if you reside in a community property state, which is a state where you are required to split equally all assets acquired during a marriage. The following are community property states: Arizona. California.

Is it better to claim single or divorced on taxes?

Divorced or separated taxpayers who qualify should file as a head of household instead of single because this status has several advantages: there’s a lower effective tax rate than the one used for those who file as single. the standard deduction is higher than for single individuals.

Does filing single get more money?

Only unmarried people can use the single tax filing status, and their tax brackets are different in certain spots from if you’re married and filing separately. People who file separately often pay more than they would if they file jointly.

How long do you have to be divorced to file single on taxes?

Filing as Head of Household If You’re Separated You might qualify as head of household even if your divorce isn’t final by Dec. 31 if the IRS says you’re “considered unmarried.” According to IRS rules, this means: You and your spouse stopped living together before the last six months of the tax year.

How do I file my taxes with 50 50 custody?

The one who had custody for more than 1/2 of the year can claim the child as a dependent, child care expenses, earned income tax credit and, if eligible, Head of Household. The custodial parent can transfer the exemption to the non-custodial parent by providing them with a signed copy of Form 8332.