Can my ex wife be on my insurance?

Table of Contents

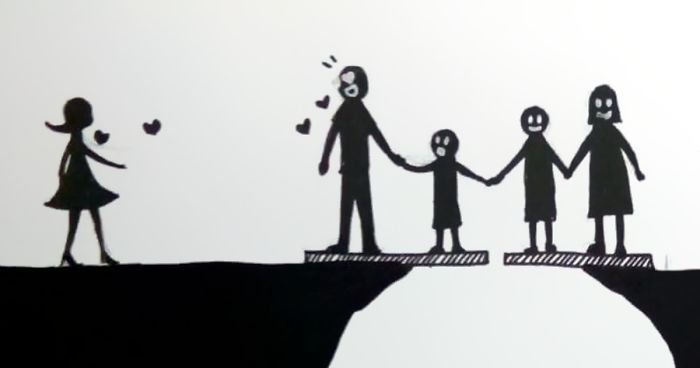

Can my ex wife be on my insurance?

Federal law dictates that health insurance coverage ends as soon as you are divorced. However, most insurance plans allow an ex-spouse to get health insurance through COBRA for up to 36 months following a divorce….

How long can I stay on my ex husband’s insurance?

After you get divorced, you may be able to temporarily keep your health coverage through a law known as “COBRA.” If your former spouse got insurance through an employer that has at least 20 employees, COBRA lets you stay on that plan for up to 36 months….

Can you keep life insurance on a divorced spouse?

If your ex-spouse took out a life insurance policy that insures you and pays out a death benefit to them in the event of your death, they can keep that policy even after your divorce. This is because only the policyholder can cancel or change a life insurance policy.

What counts as a qualifying event?

Examples of qualifying events include the birth or adoption of a child, death of a spouse, or a change in marital status….

What is a qualifying life event IRS?

Qualifying life events are those situations that cause a change in your life that has an effect on your health insurance options or requirements. The IRS states that a qualifying event must have an impact on your insurance needs or change what health insurance plans that you qualify for….

Who is not eligible for Section 125 plan?

The Section 125 rules specifically prohibit the following individuals from participating: • Self-employed individuals; • Partners within a partnership; and • More than 2 percent shareholders in a subchapter S corporation (S corporation).

What is the tag along rule?

The Tag Along rule allows all eligible dependents to be enrolled upon a qualifying life event for enrollment. In the example of the birth of a new child, the employee will now be allowed to enroll the newborn, their spouse, and all other eligible children….

What are Hipaa special enrollment rights?

Special enrollment allows individuals who previously declined health coverage to enroll for coverage. Under the first, employees and dependents who decline coverage due to other health coverage and then lose eligibility or lose employer contributions have special enrollment rights.

Is quitting a job a qualifying life event?

1. Leaving your job. If you have insurance through your employer and you either quit or lose your job, you qualify for a special enrollment period.

Is becoming Medicare eligible a qualifying event?

Being eligible to enroll in Medicare does not constitute being “entitled” to Medicare. Although a loss of coverage occurs when employees voluntarily remove themselves from the health plans, the reason (attaining other coverage, including Medicare) is not considered a qualifying event.

Is a change in income a qualifying event?

Qualifying life events revolve around changes in job, location, income, or family status. For example, a change in family status or household size qualifies. This could include marriage, separation, gaining a dependent, losing a family member, and court-ordered family dependent changes.

Does moving count as a qualifying event?

For people who meet the prior coverage requirement, a permanent move to a new state will always trigger a special open enrollment period, because each state has its own health plans. But even a move within a state can be a qualifying event, as some states have QHPs that are only offered in certain regions of the state.