How often do lottery winners go broke?

Table of Contents

How often do lottery winners go broke?

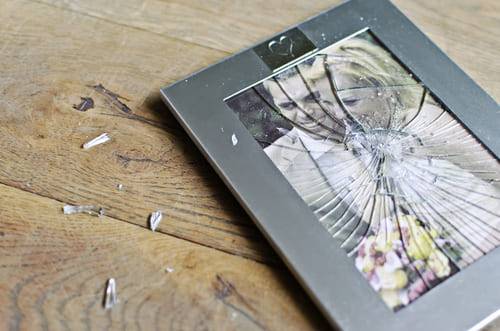

According to the National Endowment for Financial Education, about 70 percent of people who win a lottery or receive a large windfall go bankrupt within a few years.

What is the first thing to do if you win the lottery?

What to Do Before Claiming Your Prize

- Protect Your Ticket.

- Don’t Rush to Claim Your Prize.

- Don’t Quit Your Job or Spread News of Your Good Fortune.

- Hire Professionals.

- Change Your Address & Go Unlisted.

- Taking the Lump-Sum Payout.

- Taking the Long-Term Payout.

- Consult With the Professionals You Hired.

How much should I pay in federal taxes if I make 100k?

For example, in 2020, a single filer with taxable income of $100,000 willl pay $18,080 in tax, or an average tax rate of 18%. But your marginal tax rate or tax bracket is actually 24%.

How much taxes will I pay if I make 200k?

The 2018 Income Tax Rates

| Rate | Single | Married Filing Jointly |

|---|---|---|

| 24% | $82,501 – $157,500 | $165,001 – $315,000 |

| 32% | $157,501 – $200,000 | $315,001 – $400,000 |

| 35% | $200,001 – $500,000 | $400,001 – $600,000 |

| 37% | More than $500,000 | More than $600,000 |

What are the tax bracket amounts?

How We Make Money

| Tax rate | Single | Married filing jointly or qualifying widow |

|---|---|---|

| 10% | $0 to $9,875 | $0 to $19,750 |

| 12% | $9,876 to $40,125 | $19,751 to $80,250 |

| 22% | $40,126 to $85,525 | $80,251 to $171,050 |

| 24% | $85,526 to $163,300 | $171,051 to $326,600 |

How much should a single person pay in federal taxes?

The federal government and most states use a system of “progressive” income tax rates. This means that as your taxable income increases, so does your maximum tax rate. In the 2020 tax year, for example, single people with a taxable income of $9,875 or less pay federal income tax at the tax rate of 10 percent.