Can my wife stay on my health insurance after divorce?

Table of Contents

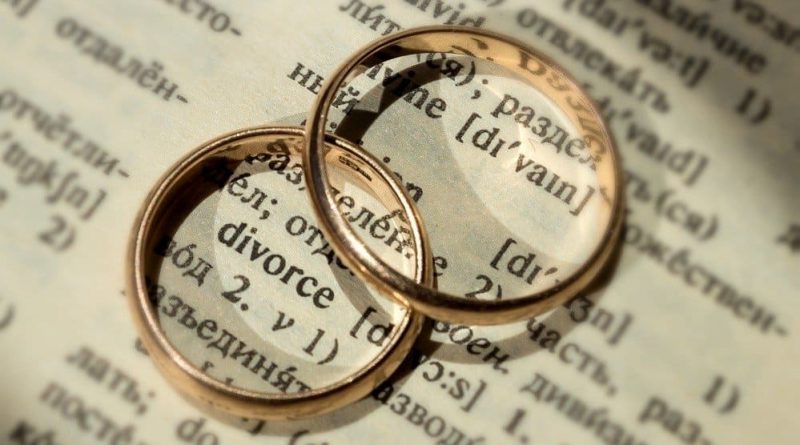

Can my wife stay on my health insurance after divorce?

The law in the United States is that once your divorce occurs, health insurance coverage ends as well if your insurance is had through your spouse.

Do I have to pay my ex wife health insurance?

Federal law dictates that health insurance coverage ends as soon as you are divorced. However, most insurance plans allow an ex-spouse to get health insurance through COBRA for up to 36 months following a divorce.

Can my husband keep me on his health insurance after divorce?

Unfortunately, no. This can be a stipulation in a child custody or child support agreement following a divorce, but as for spousal support, your ex-husband does not have to keep you on his health insurance.

What are the reasons for legal separation?

Grounds for legal separation typically mirror state grounds for divorce and can include the following: incompatibility, abandonment, adultery and cruelty. Just as in a divorce, the child custody, child support, and spousal support conditions can only be modified with court approval.

What are the effects of legal separation?

Legal separation lets spouses live apart and awards net profits to the spouse without fault. Subject to court discretion on the best interests of the child, the custody of the minor children will be awarded to the innocent spouse.

Do I have to report inheritance on my tax return?

You won’t have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income. But the type of property you inherit might come with some built-in income tax consequences.

Do you have to declare inheritance money?

You don’t usually pay tax on anything you inherit at the time you inherit it. You may need to pay: Income Tax on profit you later earn from your inheritance, eg dividends from shares or rental income from a property. Capital Gains Tax if you later sell shares or a property you inherited.