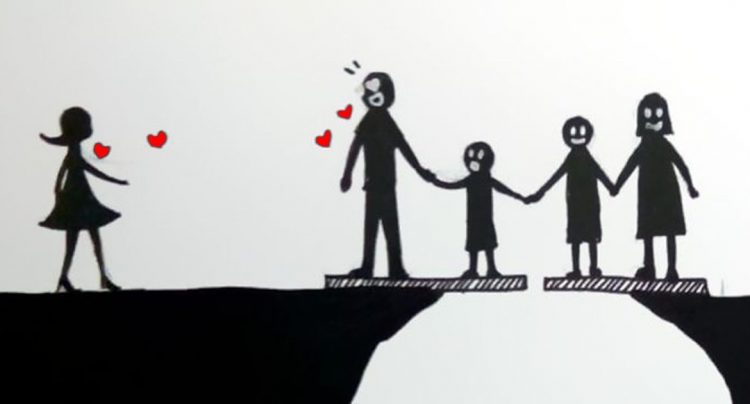

How can a stay at home mom afford a divorce?

Table of Contents

How can a stay at home mom afford a divorce?

Divorce & The Stay-At-Home MomGet all of your financial documents together: Gain access to funds: Craft a new budget: Know what the marital house is worth: Get a handle on your credit: Plan to return to work: Consider requesting temporary alimony: Hire a team of qualified professionals:

How do stay at home moms protect themselves financially?

5 Ways to Protect the Finances of Stay at Home SpousesSave for Retirement. Most retirement accounts are tied to a job. Get Life Insurance. You may have read that life insurance is only necessary for income replacement. Get It In Writing. Understand Disability Insurance. Hone Skills & Consider Part-Time Work.

What to do if you want a divorce but can’t afford it?

You can “start custody and support proceedings in family court yourself without an attorney. This will allow you to receive some money on a regular basis from your spouse while you determine how you will file for a divorce.”

Who pays the QDRO fees in divorce?

It is the divorce attorney’s obligation to make arrangements to have the QDRO drafted, and the failure to do so may be possible malpractice and/or an ethical violation, but once arrangements are made to have the document drafted, it is the client’s responsibility to pay for the cost.

Who pays the taxes on a QDRO distribution?

A QDRO distribution that is paid to a child or other dependent is taxed to the plan participant. An individual may be able to roll over tax-free all or part of a distribution from a qualified retirement plan that he or she received under a QDRO.

How is a QDRO paid out?

A QDRO will instruct the plan administrator on how to pay the non-employee spouse’s share of the plan benefits. A QDRO allows the funds in a retirement account to be separated and withdrawn without penalty and deposited into the non-employee spouse’s retirement account (typically an IRA).

Can I cash out my QDRO?

A QDRO can apply to any retirement or pension account covered by the Employee Retirement Income Security Act (ERISA). One huge benefit of a QDRO is that it allows for early withdrawals from a 401(k) or other qualified retirement plan without incurring a penalty.

Is a QDRO considered income?

Taxes. When an ex-spouse receives distribution of plan benefits pursuant to a QDRO, he or she is responsible to pay the associated income tax. Distributions made pursuant to QDROs are generally taxed in the same manner as any other “typical” plan distribution.