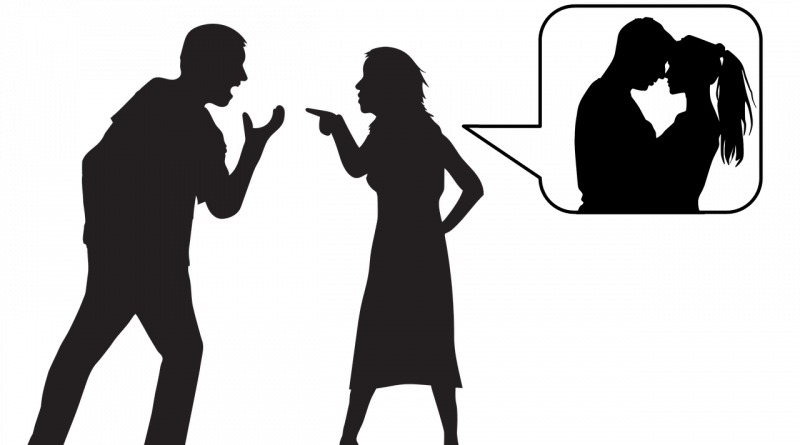

Can I get a loan without my husband knowing?

Can I get a loan without my husband knowing?

Loan application with stamp of approval. When you get married, nothing prevents you from applying for credit as an individual borrower. In many instances, you can establish credit accounts without the knowledge of your spouse.

Is your marital status on your credit report?

Marriage has no effect at all on your credit reports or the credit scores based upon them because the national credit bureaus (Experian, TransUnion and Equifax) do not include marital status in their records. Your borrowing and payment history—and your spouse’s—remain the same before and after your wedding day.

When you get married does your spouse’s debt become yours?

When one or both partners have debt coming into the marriage, the debt belongs solely to the person that incurred them. 1 Say, for example, you have $15,000 in private student loans in your name. Your spouse-to-be has $10,000 in credit card debt in their name.

How can I share my credit card with my husband?

There are two options for sharing a card, Kuderna explains. You can open a joint card or have the spouse with the lower credit score become an authorized user on the other’s credit card. Just be aware that some cards charge a fee for authorized users.

Do spouses have the same credit score?

If you have joint financial accounts and credit cards with your spouse, you may expect your credit scores to be the same, but that isn’t necessarily the case. More often than not, your credit score will be different from your spouse’s. It’s not an error with the credit scoring. It’s perfectly normal.

Do you share a credit score with your spouse?

Getting married and changing your name won’t affect your credit reports, credit history or credit scores. One spouse’s poor credit won’t impact the other spouse — unless you jointly apply for a loan or open a joint account.

Can my husband use my credit card?

Couples can make one another an authorized user on their credit card accounts. The authorized spouse gets his or her own card to use, but the primary account holder is responsible for the bill. For example, a husband and wife can each apply for separate cards, and then authorize the other to use the cards.

Can I use my husbands credit card without permission?

When a person uses a card without a card holder’s permission, this is illegal. Under U.S. law, if the person reports unauthorized use, he is only responsible for a maximum of $50 in charges. Either the retailer or the credit card company will be responsible for any charges made without proper authorization.

Why is my husband’s credit card on my credit report?

There are two possibilities why your husband’s debts are on showing up on your credit report. In the second scenario, your husband may have fraudulently used your personal information to make you a joint account holder on his credit cards, leaving you equally responsible for any debts he ran up.

Will adding my husband to my credit card improve his credit?

Adding your spouse as an authorized user to your credit card won’t hurt your credit score, but it could help your spouse’s. Your credit score reflects only your credit history, so your score will not include your wife’s accounts.