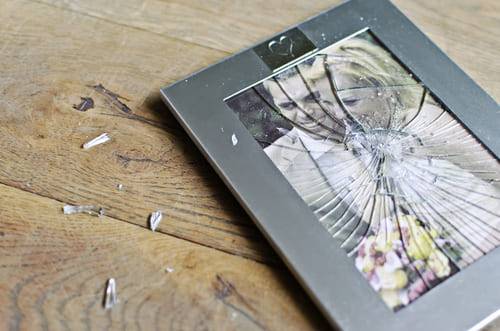

Can I lose my permanent resident status if I get divorced?

Table of Contents

Can I lose my permanent resident status if I get divorced?

A divorce may make it harder to become a permanent resident, but it is still possible. If you already have a green card and are a permanent resident at the time of the divorce, the divorce should not change your status. However, the divorce may force you to wait longer to apply for naturalization.

Can a spouse visa be revoked?

The quick answer is that your husband can’t cancel your Spouse visa. That is because your Spouse visa was issued by the Home Office and not by your husband or spouse. Therefore, only the Home Office has the power and authority to cancel your Spouse visa or to make you leave the UK.

How does Uscis investigate marriages?

Usually, the USCIS officers may visit the suspect couple at their residence, or visit their neighbors to investigate whether they reside together, share a household, or own property jointly, etc. The USCIS officers may also arrange interviews with the couple at their residence or at USCIS offices.

Can Uscis check your bank account?

Even if you provided your SSN and are on the payroll, it’s not possible for USCIS to find out unless they see your tax records. No immigration officers do not have access to your bank statements unless you provide them. They can if they feel there is a fraud.

How many cases does Uscis process a day?

2,500 applications

Does Uscis come to your house?

One of the things we’ve learned is that in many marriage cases, USCIS comes to visit the house. They want to make sure that the address on file is valid. But if you do have a marriage case on file, they’re probably at some point going to come check you out.

Does Uscis check your phone?

It doesn’t. The best strategy is simply to assume that anything you post online will be seen and examined by immigration authorities. Some immigration attorneys may even recommend that you refrain from social media use entirely while your visa or green card application is pending.

Can immigration read your text messages?

If you are at U.S. port of entry or under investigation DHS may be able to view your phone calls and text messages. DHS also views your social media information.

Does immigration check your Facebook?

Social media platforms listed on the forms will include Facebook, Instagram, Twitter, and LinkedIn. The agency says it will not ask for passwords and will only look at publicly available information to determine whether an applicant “poses a law enforcement or national security risk to the United States.”

Why would a partner visa be refused?

Lack of evidence to prove a genuine and committed relationship is the most common reason for the refusal of partner visas. Applicants and their partner/spouse sponsor need to provide evidence in the following four aspects, namely, financial, social, nature of household and nature of commitment to one another.

Can immigration spy on you?

If you’re an immigrant, green card holder, or naturalized citizen—or if you have interacted with someone matching that description—the Department of Homeland Security (DHS) is monitoring you.

Does immigration check tax returns?

USCIS will review your tax returns (for any relevant years) to confirm that they were filed jointly. Submitting jointly filed tax returns is essential evidence to be included with the I-751 petition.

Can IRS report you to immigration?

Those immigrants can file their taxes without fear of deportation as the IRS doesn’t report their illegal status to homeland security.

How do I file my taxes if my husband is illegal?

If your spouse is a nonresident alien and you file a joint or separate return, your spouse must have either a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN). To get an SSN for your spouse, apply at a social security office or U.S. consulate. You must complete Form SS-5.

Can married filing separately affect immigration?

Some couples may have filed “married filing separate.” Although this is not ideal, it isn’t necessarily a problem. It does not prevent you from successfully filing N-400 to become a U.S. citizen. The choice to file married but separate could have been made because of a tax advantage.