Can I split my income with my spouse?

Table of Contents

Can I split my income with my spouse?

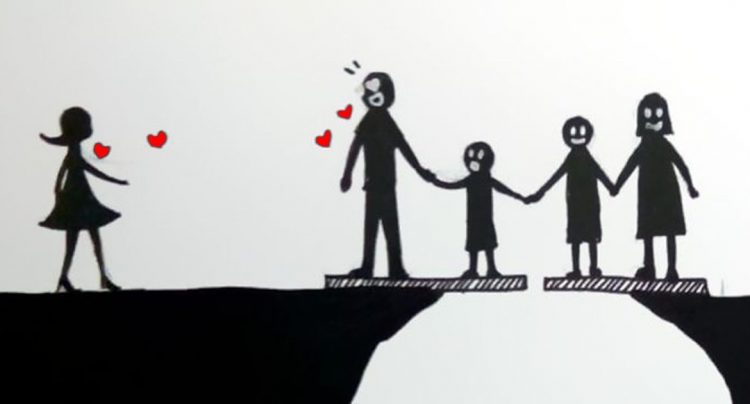

One way to lower your household’s tax liability is to consider income splitting. This works best if one spouse earns significantly more than the other spouse does. Income splitting lets the higher-income spouse shift some of their income to the lower-income spouse (whether they are married or common-law).

Is money given to spouse taxable?

According to the income tax law, if you give some money, which is not part of your income, as gift to your wife then you will not get any kind of tax rebate on it. According to the law, it will be considered your own income and so the tax liability will be yours too.

Can I give my wife money to invest?

To understand why a spousal loan can be a good tax strategy, you must first know how the Canada Revenue Agency (CRA) usually treats exchanges of money between spouses. In most cases, if you gift money to your spouse to invest, any income earned on that money is subject to Attribution rules.

Can I sell my house to my son for $1 dollar in Canada?

A principal residence is tax-free for capital gains tax purposes upon sale or upon death. In this regard, anything you do to transfer it to your son now will be income tax-free, but it would also be tax-free later.

How much can my parents give me tax-free?

$15,000

How much money can a person receive as a gift without being taxed 2019?

Every year, you can give up to a certain amount to anyone you want without having to deal with the gift tax at all. For 2018 and 2019, that amount is $15,000. With the annual exclusion provision, you’re allowed to make multiple $15,000 gifts to as many different people as you want.

How do I pay taxes if I get paid in cash?

If you are an employee, you report your cash payments for services on Form 1040, line 7 as wages. The IRS requires all employers to send a Form W-2 to every employee. However, because you are paid in cash, it is possible that your employer will not issue you a Form W-2.

What is lifetime exemption?

Starting in 2020, the lifetime gift tax exemption is $11.58 million. This means that you can give up to $11.58 million in gifts over the course of your lifetime without ever having to pay gift tax on it. For married couples, both spouses get the $11.58 million exemption.