Is same sex marriage legal in Florida?

Table of Contents

Is same sex marriage legal in Florida?

Same-sex marriage has been legally recognized in the U.S. state of Florida since January 6, 2015, as a result of Brenner v. Scott, the lead case on the issue. In this case, a U.S. district court ruled the state’s same-sex marriage ban unconstitutional on August 21, 2014.

Is a DOMA a house?

Doma refers to the space between indoors and outdoors in a Japanese house. Used as a workshop, kitchen or storage space, this feature of traditional architecture is both rare and popular in our modern times.

Does Missouri have domestic partnership?

Missouri Domestic Partnerships Louis City Ordinance 64401 is one example of domestic partnership law in Missouri. It stipulates that a domestic partnership will be legally recognized, only if both parties: are registered as partners. are not married, blood-related, or in a civil union.

Is common law marriage in Missouri?

Common law marriage allows for a couple to be considered formally married even if they have not had a wedding or not been formally married under according to civil or religious ceremony. Common law marriage is only valid in a handful of states and Missouri is not a common law marriage state.

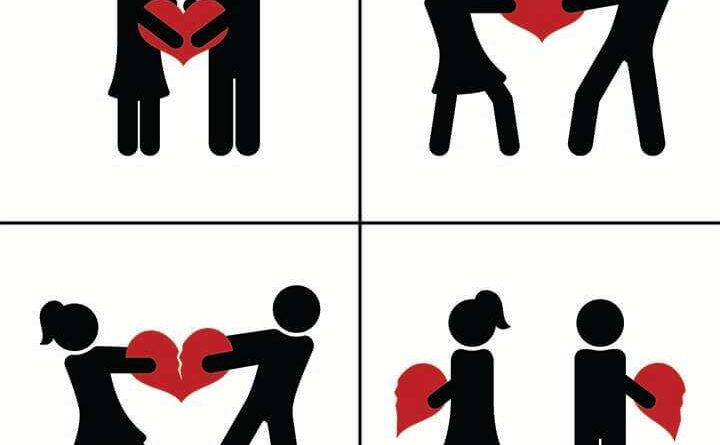

How is a domestic partnership different from marriage?

A domestic partnership is an interpersonal relationship between two individuals who live together and share a common domestic life, but are not married (to each other or to anyone else). People in domestic partnerships receive benefits that guarantee right of survivorship, hospital visitation, and others.

Can domestic partners file taxes together?

Registered domestic partners may not file a federal return using a married filing separately or jointly filing status. Registered domestic partners are not married under state law. Therefore, these taxpayers are not married for federal tax purposes.

Can you claim your unmarried partner as a dependent?

You can claim your partner as a dependent if your situation meets all of the following conditions: Your partner cannot be married to someone else and file a joint return with that other person except to claim a refund of withheld income tax or estimated income tax paid.

Does my girlfriend count as a Dependant?

You can claim a boyfriend or girlfriend as a dependent on your federal income taxes if that person meets the Internal Revenue Service’s definition of a “qualifying relative.”

Can my boyfriend claim my child on taxes?

A. Yes, if they meet all the IRS requirements for dependents. However, the IRS now says if the parent’s income is so low that he or she doesn’t have to file a tax return, then the boyfriend who lives with the mother and child all year long can claim the mother and the child as dependents.