How does divorce affect Medicaid eligibility?

How does divorce affect Medicaid eligibility?

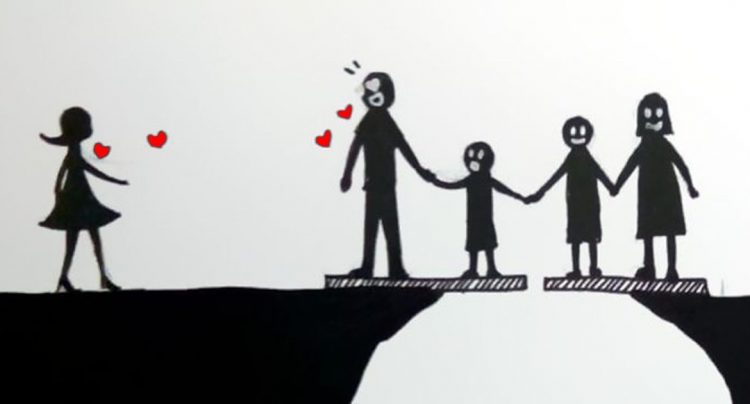

The answer is simple: Divorce, or to be technically accurate, a “Medical/Medicaid Divorce” (depending on the lawyer you ask). A couple, despite being happy, gets a divorce “on paper” so that one of the people in the marriage, or one of their kids, can become eligible for Medicaid.

Can Medicaid Take your spouse’s assets?

Medicaid puts a limit on the amount of assets BOTH spouses are allowed to have. The exact numbers vary from state to state, but there are some general rules that apply in most of the country. In the majority of states, the HEALTHY spouse is allowed to have up to $126,000 in savings.

Can I get Medicaid if I’m married but separated?

Medicaid can pursue recovery of assets against a separated spouse even if the spouse were separated from and living apart from the applicant prior to the applicant’s institutionalization, although the separated spouse’s refusal to divulge income and asset information will not affect the applicant’s eligibility.

How do I protect my inheritance from Medicaid?

Through the creation of certain irrevocable Supplemental Needs Trusts, you can protect your Medicaid benefits in the event you are the recipient of an inheritance, personal injury claim or divorce award.

Is Medicaid changing in 2020?

Medicaid expansion will wind down in 2020. 1, 2020, the federal government will no longer fund newly enrolled child- less adults (the expansion population). Changes to Medicaid expansion could increase the un- insured rate, emergency department visits, and uncompensated care.

Can someone on Medicaid receive an inheritance?

Medicaid has strict income and resource limits, so an inheritance can make a Medicaid recipient ineligible for Medicaid. Careful planning is necessary to make sure the inheritance doesn’t have a negative impact. An inheritance will be counted as income in the month it is received.

Can you hide money from Medicaid?

“Hiding” assets by not reporting them on the Medicaid application is illegal and considered fraud against the state, with both civil and criminal penalties. For example, she can make an outright gift to you and then wait five years to apply for Medicaid.

Does Medicaid look at your bank account?

Medicaid requires that you to have very little savings in the bank – about $2000. When it comes to income and assets, there are a lot of rules for lots of different circumstances. Medicaid will actually go look at all your parent’s bank statements over the last five years and examine every little transfer they made.

What assets are protected from Medicaid?

Assets that do not get counted for eligibility include the following:Your primary residence.Personal property and household belongings.One motor vehicle.Life insurance with a face value under $1,500.Up to $1,500 in funds set aside for burial.Certain burial arrangements such as pre-need burial agreements.Weitere Einträge…•

How far back does Medicaid look for assets?

When you apply for Medicaid, any gifts or transfers of assets made within five years (60 months) of the date of application are subject to penalties. Any gifts or transfers of assets made greater than 5 years of the date of application are not subject to penalties. Hence the five-year look back period.

How do I stop Medicaid from taking my house?

Generally speaking, there are three ways you can protect your home from a Medi-Cal lien:Gift your house to your children or another family member. Medi-Cal can’t recover what isn’t yours. Create an irrevocable living trust. Life estate.

Can Medicaid go after a trust?

Medicaid considers the principal of such trusts (that is, the funds that make up the trust) to be assets that are countable in determining Medicaid eligibility. Thus, revocable trusts are of no use in Medicaid planning. An “irrevocable” trust is one that cannot be changed after it has been created.

Can nursing home take your house if trust?

A revocable living trust will not protect your assets from a nursing home. This is because the assets in a revocable trust are still under the control of the owner. To shield your assets from the spend-down before you qualify for Medicaid, you will need to create an irrevocable trust.

Can Medicaid recover from an irrevocable trust?

An irrevocable trust can protect your assets against Medicaid Estate Recovery. When you or your spouse (if they are part of the trust) pass away, any assets put into an irrevocable trust are not included in the estate for the calculation of Medicaid recovery, the estate tax, or probate.

Why put your house in a irrevocable trust?

Putting your house in an irrevocable trust removes it from your estate. Unlike placing assets in an revocable trust, your house is safe from creditors and from estate tax. When you die, your share of the house goes to the trust so your spouse never takes legal ownership.

What is the downside of an irrevocable trust?

The main downside to an irrevocable trust is simple: It’s not revocable or changeable. You no longer own the assets you’ve placed into the trust. In other words, if you place a million dollars in an irrevocable trust for your child and want to change your mind a few years later, you’re out of luck.

Can you sell your house if it’s in an irrevocable trust?

Buying and Selling Home in a Trust Answer: Yes, a trust can buy and sell property. Irrevocable trusts created for the purpose of protecting assets from the cost of long term care are commonly referred to as Medicaid Qualifying Trusts (“MQTs”).

Who owns the property in an irrevocable trust?

With an irrevocable trust, the trustor passes legal ownership of the trust assets to a trustee. However, this means those assets leave a person’s property effectively lowering the taxable portion of an individual’s estate. The trustor also relinquishes certain rights to mend the trust agreement.

Who pays taxes on an irrevocable trust?

Trusts are subject to different taxation than ordinary investment accounts. Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust, but not on returned principal. IRS forms K- are required for filing tax returns that receive trust disbursements.

Can the IRS seize assets in an irrevocable trust?

Irrevocable Trust If you don’t pay next year’s tax bill, the IRS can’t usually go after the assets in your trust unless it proves you’re pulling some sort of tax scam. If your trust earns any income, it has to pay income taxes. If it doesn’t pay, the IRS might be able to lien the trust assets.