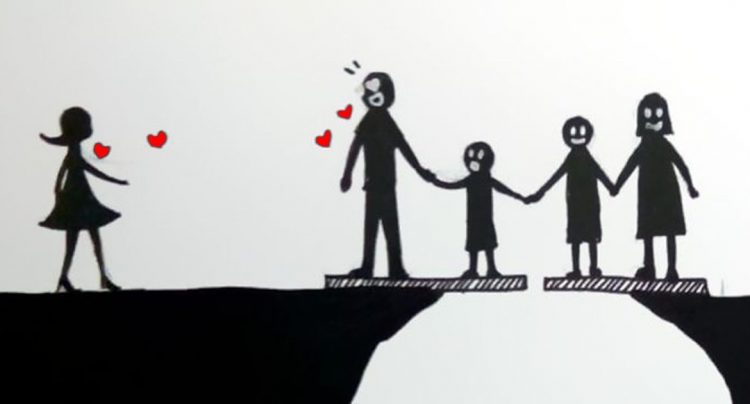

Will my child support increase if I get a second job?

Will my child support increase if I get a second job?

So, in general, the answer is no, you will not have to pay more child support for your second job. If one parent normally and consistently worked more than 40 hours at their job (overtime pay), the court can take this into account when issuing a child support order.

Can child support take money from my second job?

Wage Garnishment with Two Jobs in California Child support calculations are based on your total income, and should reflect the amount that you make from multiple jobs. This means California cannot take so much money that they leave you with less than that amount.

What the most they can take for child support?

According to federal law, a maximum of 65% of your remaining paycheck can be withheld for past due child support.

Can u be garnished twice?

By federal law, in most cases only one creditor can lay claim to your wages at a single time. In essence, whichever creditor files for an order first gets to garnish your paycheck. In that case, another creditor’s order can be put into effect up to the amount allowed by law to be taken out of each of your paychecks.

How much of your check can be garnished?

The maximum amount that can be garnished In Alberta, for instance, you keep the first $800 of your monthly net income, then creditors can garnish 50% of your monthly net income between $800 and $2400, and 100% of any net income above $2400.

How much can the IRS garnish from your paycheck?

The IRS can take some of your paycheck The IRS determines your exempt amount using your filing status, pay period and number of dependents. For example, if you’re single with no dependents and make $1,000 every two weeks, the IRS can take up to $538 of your check each pay period.

Can I be fired for wage garnishment?

Employees cannot be fired because their wages are garnished. Federal law protects you from being fired simply because your wages are being garnished for a single debt. However, if your wages are being garnished for two or more debts, your employer can fire you if it decides to do so.

How do I dispute a garnishment?

In some situations, you can prevent a wage garnishment without bankruptcy.Respond to the Creditor’s Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

Can the IRS take all the money in your bank account?

When placing a levy, the IRS contacts the bank and asks it to hold the funds in your bank account(s) for a period of 21 days. The bank cannot refuse to send the money to the IRS. The IRS can seize up to the total amount of your tax debt from your bank account.

What’s the most the IRS can garnish?

The IRS can levy as much as 15 percent of your Social Security or use other retirement plans, too. Plus, there is a major requirement when trying to use these options to time pay or eliminate a tax debt; you need be up to date on all filings and current on taxes.

What happens if I owe a tax stimulus check?

If you owe taxes to the U.S. government, the IRS cannot seize your stimulus check. There is no offsetting for amounts owed in taxes or under a tax payment agreement, Stern says.

What percentage will the IRS settle for?

Besides the user fee of $205, the IRS will want the taxpayer to pay part of the OIC offer amount with the application. If the taxpayer selects the lump sum payment method, the IRS will want 20% of the offer amount. In our example, that would be 20% of $12,400 – or $2,2020

Does IRS forgive tax debt?

The IRS rarely forgives tax debts. Form 656 is the application for an “offer in compromise” to settle your tax liability for less than what you owe. Such deals are only given to people experiencing true financial hardship.

What happens if you owe the IRS more than 50000?

6. Some agreements come with a federal tax lien. However, if your client owes more than $50,000 (which is rare) or owes more than $10,000 and can’t pay within six years, the IRS will usually file a tax lien.