Is Montana a 50 50 State for divorce?

Table of Contents

Is Montana a 50 50 State for divorce?

Montana is NOT a community property state, which means that marital property is not automatically divided 50/50 between the spouses in a divorce case. Factors such as one spouse’s economic misconduct may also be considered.

Should a husband and wife have separate bank accounts?

Each spouse has every right to withdraw money and close the account without the consent of the other, and one party can easily leave the other penniless. Separate bank accounts prevent that scenario and can allow for an easier break that often doesn’t involve a long fight to fully separate the finances.

What percentage of married couples have separate bank accounts?

But 77 percent of Bankrate’s married survey respondents said they share at least one bank account with their partner—this response comes mostly from Americans with an income of $75,000 or more. That’s why before joining financial forces, it’s crucial to have a chat about money.

Can I add my spouse to my bank account online?

Though the information on how to add your spouse to your bank account may be found online, it is usually not possible to add your spouse to the account online. Most banks will require you to go to the local branch so they can make copies of the required documentation.

Can my spouse access my bank account?

If your wife has an account that is only in her name, then you cannot access that account without her permission. You may deposit funds into it, but legally the only person who can access, withdraw or transfer funds is the person authorized to sign on the account.

Should married couples pool their money?

At the end of the day, keeping separate finances makes it easier to hide purchases and keep secrets, whereas joint accounts promote transparency and trust. A couple who pools finances together may be less likely to hide transactions or lie since they are jointly and individually accountable for the money they earn.

Who should pay the bills in a marriage?

You need a system for paying bills that feels fair to both of you. Some couples pay their household bills from a joint account to which both spouses contribute. Others divide the bills, with each partner paying his or her share from their individual accounts. What’s important is to make it an equitable division.

What do you do with your bank account when you get married?

Keep the process simple if you and your spouse already have accounts at the same bank. You’ll both have to show up with valid ID. Then you can close one spouse’s accounts completely, transfer their money to the other spouse’s accounts, and add their name. Or you can open new ones with both spouses as account holders.

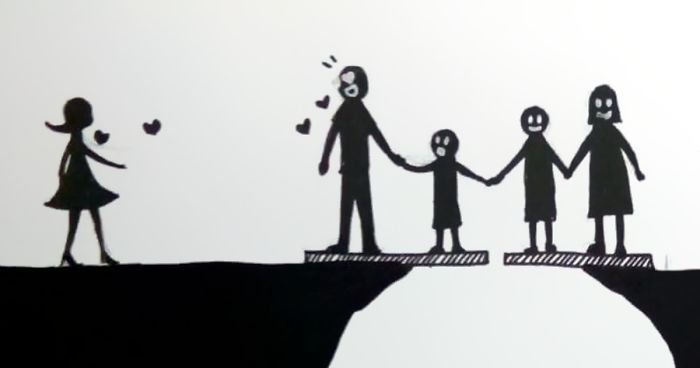

Should relationships be 50 50 financially?

Keeping your relationship 50/50 financially might sound like the easiest and best way to keep things equal. But splitting expenses 50/50 doesn’t always work. If one partner makes more, spends more, or has more debt, balancing what each partner contributes and how much they spend is more important.

Should you split bills 50/50 with your spouse or partner?

Splitting bills 50/50 with your spouse or partner is very common. Generally, just agreeing to split 50/50 will alleviate the headache of finding another method. 50/50 works great when both partners have similar incomes and split resources equally. Your husband might eat more food while your wife might use more water.

Should I split the bill with my boyfriend?

On the first date, a guy should pay no matter what the lass says – if he wants to see her again, that is. If there’s a second date and she offers to split, you’re good. After the third date it should be split, unless it’s a special occasion.

Do guys like paying for dates?

So as a man you should always expect to pay for the date. After all you want her to be able to relax and enjoy her time with you. And that will be difficult if she’s worried about the money she’s spending. Another reason it’s important for men to pay for a date is that it sends a clear message of your intentions.

How do bills split in a relationship?

Here’s how it goes:

- Keep your individual bank accounts, but also open a joint checking account together.

- Add your individual incomes together to get your total household income.

- Add up all the expenses you’ve agreed to split.

- Every month, both partners transfer their share into the joint account.

How do you split rent with your boyfriend?

Divide expenses based on each partner’s income. Here’s an easy example: if you make $60,000 and your partner makes $40,000, your total income is $100,000. You earn 60% of the total, and your partner makes 40% of it. Therefore, for all your shared expenses, you will pay 60% each month while your partner pays 40%.