Which parent has legal right to claim child on taxes?

Which parent has legal right to claim child on taxes?

Single parents with primary custody can claim the amount for an eligible dependant (sometimes called equivalent to spouse) for one child.

Who claims child tax credit in divorce?

If your spouse lives with and supports your minor child, he/she may claim the eligible dependant credit for the child. Claiming this non-refundable tax credit is made on Schedule 1 and the corresponding provincial or territorial Form 428.

Can my boyfriend claim my child on his taxes?

A. Yes, if they meet all the IRS requirements for dependents. However, the IRS now says if the parent’s income is so low that he or she doesn’t have to file a tax return, then the boyfriend who lives with the mother and child all year long can claim the mother and the child as dependents.

What are the tiebreaker rules for a qualifying child?

Under the tiebreaker rules, the child is generally treated as a qualifying child of:The parents if they file a joint return and claim the child a qualifying child;The parent if only one of the persons is the child’s parent and the parent claims the child as a qualifying child;Meer items…•

What is the tie breaker rule?

Under the Tiebreaker Rule, the Child is Treated as a Qualifying Child Only By: The parents, if they file a joint return;. The parent, if only one of the persons is the child’s parent; A person with the higher AGI than any parent who can claim the child as a qualifying child but does not.

What are the five test for qualifying child?

The five dependency tests – relationship, gross income, support, joint return and citizenship/residency – continue to apply to a qualifying relative. A child who is not a qualifying child might still be a dependent as a qualifying relative.

Will the IRS tell you who claimed your child?

The IRS won’t tell you who claimed your dependent. Usually, you can identify the possibilities and ask (commonly, a former spouse). But if you don’t suspect anyone who could have claimed the dependent, your dependent may be a victim of tax identity theft.

Can I claim my girlfriend’s child on taxes?

You can claim a boyfriend or girlfriend and their children as dependents if they are your qualifying relatives. they are not a qualifying child of another taxpayer. Also, the child will not qualify you for earned income credit, child tax credit or the child and dependent care credit (again, because you’re not related.)

Do I get a stimulus check if someone claimed me?

Adults who are claimed as dependents do not get stimulus checks. The person who claimed them also do not get dependent benefits.

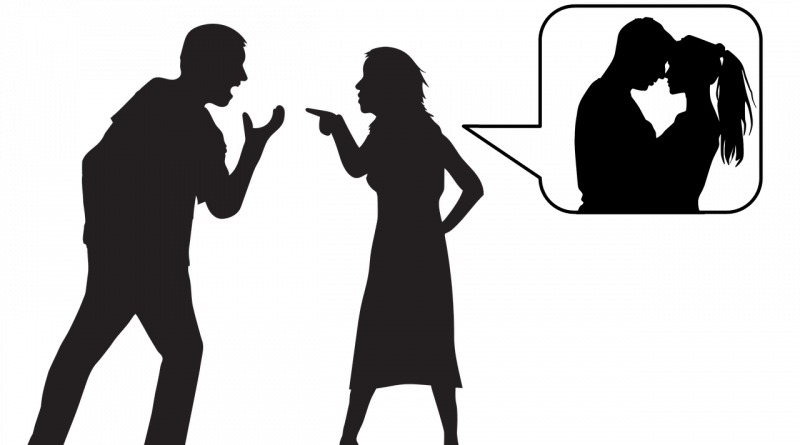

What happens when two parents claim the same child on their tax return?

If both parents claim the same child for child-related tax benefits, the IRS applies a tiebreaker rule. If a child lived with each parent the same amount of time during the year, the IRS allows the parent with the higher adjusted gross income (AGI) to claim the child.

What proof does the IRS need to claim a dependent 2019?

The dependent’s birth certificate, and if needed, the birth and marriage certificates of any individuals, including yourself, that prove the dependent is related to you. For an adopted dependent, send an adoption decree or proof the child was lawfully placed with you or someone related to you for legal adoption.

How can I stop someone from claiming my child on their taxes?

You cannot stop someone from completing and filing a fraudulent or incorrect tax return. All you can do is correctly complete and file your tax return.