What debts are dischargeable in Chapter 13?

What debts are dischargeable in Chapter 13?

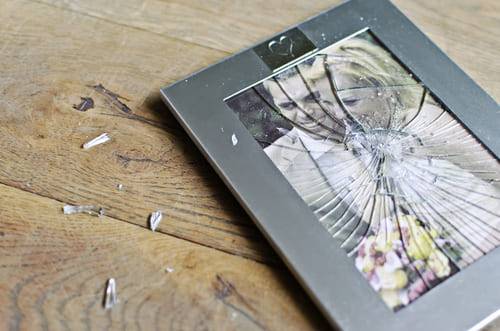

Debts dischargeable in a chapter 13, but not in chapter 7, include debts for willful and malicious injury to property (as opposed to a person), debts incurred to pay nondischargeable tax obligations, and debts arising from property settlements in divorce or separation proceedings.

How is Chapter 13 payment determined?

In Chapter 13 bankruptcy, you pay your unsecured creditors an amount between 0 and 100% of what you owe them. The exact amount is depends on these rules: (1) The minimum amount you must pay is equal to the amount your unsecured creditors would have received had you filed for Chapter 7 bankruptcy.

What happens if you get divorced while in Chapter 13?

If the divorce gets heated, you may not be able to work together in your Chapter 13. You and your spouse will have to hire new bankruptcy lawyers and file a motion with the court to split your case into two distinct Chapter 13 bankruptcy filings (or convert one of the cases to Chapter 7, or dismiss one of them).

Can the Chapter 13 trustee find out if I get credit?

Check your court or the website of the Chapter 13 bankruptcy trustee. If you incur debt or get credit without prior authorization, the court might view this as an indication that you can’t comply with the terms of your plan or that you aren’t contributing all of your disposable income.

Can I co sign while in Chapter 13?

One financial obligation you should think twice about after filing for Chapter 13 bankruptcy is co-signing on a loan. In general, it is best not to apply for a new loan or co-sign on a loan after filing. Nevertheless, co-signing on a loan is not advisable shortly after filing for Chapter 13 bankruptcy.

Can I get a cell phone while in Chapter 13?

Chapter 13 bankruptcy. Although cell phones can be a high-dollar item when purchased—even more expensive than many computers—like a new car, they lose much of their value once they’re out of the box. So you must list cell phones, just like any other asset, in the schedules.

Do I need an attorney to file Chapter 7?

You are not required to have an attorney to file for bankruptcy. In some simple Chapter 7 cases, you can file on your own (it’s called filing “pro se,” meaning that you represent yourself) if you are willing to put in some time and research. However, in many cases, it’s a good idea to have a bankruptcy attorney.

What can I keep after filing Chapter 7?

In Chapter 7 bankruptcy, exemptions determine what property you get to keep, whether it be your home, car, pension, personal belongings, or other property. If the property is exempt, you can keep it during and after bankruptcy.

What’s the difference between Chapter 13 and 7?

Chapter 7 bankruptcy, also known as a liquidation, is a legal option that can help you clear some or all of your debt. Chapter 13 bankruptcy is also a legal option that can help you get some debt discharged, but allows you to keep your property and repay your debt by completing a three- to five-year repayment plan.7 days ago

Is Chapter 7 or 13 worse?

In many cases, Chapter 7 bankruptcy is a better fit than Chapter 13 bankruptcy. For instance, Chapter 7 is quicker, many filers can keep all or most of their property, and filers don’t pay creditors through a three- to five-year Chapter 13 repayment plan.

Does your credit score go up while in Chapter 13?

So, creditors may be more likely to extend credit to you because you are less of a risk than someone who can decide tomorrow they want to file bankruptcy. Either way, once you get your discharge in a Chapter 7 bankruptcy or a Chapter 13 bankruptcy, you will get credit again and be able to increase your score.

Can I keep my car if I convert Chapter 13 to Chapter 7?

Sometimes, conversion to Chapter 7 is necessary because you can’t keep up with the payments required under your Chapter 13 plan, but conversion may be possible regardless of your reason. Depending on your situation, you may keep your house and car under Chapter 7, though generally the payment must be current.

Can you trade in your car for another car while in Chapter 13?

Can I trade in my old car? Yes, you can, but it is up to your car creditor to agree to it. Before, your car creditor received only a monthly payment by the chapter 13 trustee which stretched out over the length of the plan (usually 5 years) with the courts interest rate, currently 5.04%.

Can my Chapter 7 be denied?

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; …

How can I get out of Chapter 13 early?

You might be able to get out of Chapter 13 bankruptcy early if you can pay off your debt or you prove a financial hardship. When you enter into a Chapter 13 case, you agree to pay all of your disposable income for either 36 or 60 months.

Can I skip a chapter 13 payment?

Your Bankruptcy Case Could Be Dismissed If you fail to make your scheduled Chapter 13 plan payments, your bankruptcy trustee could ask the court to dismiss your case. And if the judge agrees that you have failed to comply with your repayment plan requirements, you won’t obtain the debt relief you need.

What happens if I voluntarily dismiss my Chapter 13?

Under Chapter 13 you do not get a discharge of your debts until the successful completion of the case. So if you dismiss your case before that completion, your debts will not be discharged. You will owe all your creditors as before except to the extent that they received payments during the case.

What happens if you win a lot of money while in Chapter 13?

If you receive an inheritance or cash gift during your Chapter 13 bankruptcy, you may have to pay more into your plan. If you receive an inheritance or cash gift while in Chapter 13 bankruptcy, you might be required to amend your repayment plan and increase what you pay to unsecured creditors.

Can I put money in savings while in Chapter 13?

Legal experts have called Chapter 13 bankruptcy, in which individuals pay back some of their debt through a repayment plan, the “wage earner’s” bankruptcy. But while it is not illegal to save money in the course of a Chapter 13 case, it’s very difficult to put it aside for savings.

How much is the average Chapter 13 payment?

Putting It All TogetherStart withYearly Income$40,000addPriority Debt$5,000addValue of Nonexempt assets$2,000Total to be paid during the Chapter 13 Plan$17,000divide by60 months to determine monthly payment$2841 more row