Does the father have to provide insurance?

Does the father have to provide insurance?

State laws, the federal mandate and the best interest of their children require parents to provide health insurance for their offspring. To do this in the most efficient and economical way, parents need to get as much information as they can about the law and the best plans available.

How does insurance work with child support?

Generally speaking, health insurance coverage for the child is considered reasonable if it’s less than 5% of the parent’s gross income, with the 5% being the difference in cost between the individual plan for the parent only, compared to the cost of the plan when the child is included.

Can a parent take their child off health insurance?

Your parents can discontinue your health insurance whether or not you give them money. There’s no law saying they need to buy or provide it for you. Federal law now requires insurers to give parents the option of keeping their adult children, up to age 26, on their health plan.

How long can I keep my kid on my insurance?

26 years

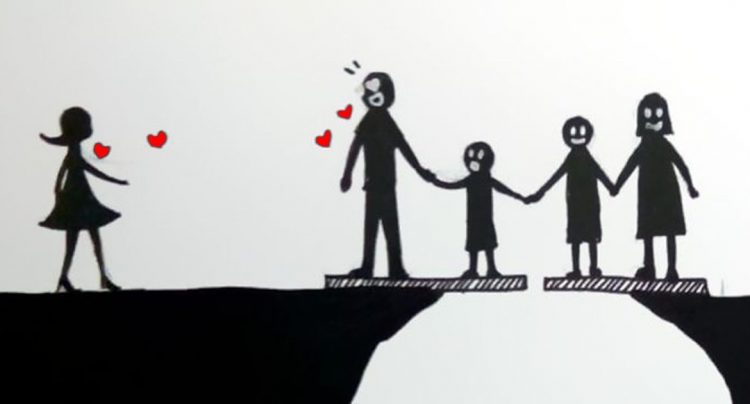

How does divorce affect health insurance?

If you are insured under a couples or family policy and you and your partner become divorced or separated, you will no longer be covered under a policy together. You must notify Bupa if your circumstances change so that you are no longer eligible to be insured under a family or couples policy.

Is legal separation considered a qualifying event?

Legal separation and divorce are considered qualifying life events. If this is a divorce, the spouse must come off all coverage as the person is no longer eligible for coverage. If a legal separation, it is optional to remove the spouse. You may also need to enroll in coverage, which you can do with this life event.